35+ disadvantage of a reverse mortgage

After you pass your heirs will receive less of an inheritance. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Warning Reverse Mortgage Downsides Disadvantages

Ad Find Out If A Reverse Mortgage Is Right For You.

. Web A reverse mortgage is the opposite of a traditional mortgage. Ad While there are numerous benefits to the product there are some drawbacks. The disadvantages to consider are the expensive closing costs that come with it and the interest it will accumulate.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web Disadvantages of a Reverse Mortgage You Are Paying to Access Your Money It Can Be Expensive You Must Pay Back the Loan When You Leave a Home Your Heirs Lose a Potential Asset Summary What is a Reverse Mortgage. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

It Could Impact Your Other Retirement Benefits. Proceeds from a reverse mortgage loan are usually tax-free and not a penny of the loan needs to be paid back if the borrower stays in the home pays property taxes and homeowners insurance and covers maintenance expenses. Web Although there can be many reverse mortgage disadvantages there are a few key problems with reverse mortgages that are of particular concern.

Reverse mortgages can be confusing. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web Web A reverse mortgage comes with several downsides like upfront and ongoing costs a variable interest rate a rising loan balance and a reduction in equity.

Your Heirs Could Inherit Less. Risk of Foreclosure A reverse mortgage releases you from the monthly principal and interest payments. This can be as much as 35 per.

Web Disadvantages of reverse mortgages in Canada Your beneficiaries will receive the value of the home after paying back the reverse Mortgage and the unpaid interest. Homeowners who suddenly vacate. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home.

Web Disadvantages of a Reverse Mortgage There are also several cons of reverse mortgages of which you should be mindful. Get A Free Information Kit. Web Lower Risk of Default.

Ad Understand the Downsides of a Reverse Mortgage Loan So You Can Make Informed Decisions. For Homeowners Age 61. In simple terms a reverse mortgage is a mechanism for you to access the equity in your home.

If you need any additional financing in the future having a reverse mortgage might limit your options. Another possible downside would be regrets by taking a reverse mortgage too early in your retirement years. You Could Lose Your Home to Foreclosure.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust. Although the advantages of reverse mortgages are hard to pass up reverse mortgages are not invincible to having some disadvantages and you deserve to know what they are.

Web Reverse mortgages are available to homeowners ages 62 and older. Ad Compare the Best Reverse Mortgage Lenders. While this might sound like a no-brainer there are pros and cons to them.

Seniors can use the payments from these specially structured loans to supplement their incomes pay for healthcare and meet their expenses. Web The Pros and Cons of a Reverse Mortgage - SmartAsset A reverse mortgage gives you access to cash based on your equity in your home. You continue to maintain.

Web Reverse Mortgage Cons. Compare 10 Lenders and Learn Pros Cons. With a traditional mortgage the borrower builds equity in his house by paying down a loan taken against the house.

Learn About Reverse Mortgages With a Free Info Kit From AAG Americas 1 Reverse Lender. One of the major reverse mortgage pitfalls involve how confusing the information can be. Higher initial setup costs when compared to traditional home loans Ongoing mortgage insurance charges MIP May affect needs based programs SSI Medicaid Becomes due if you leave home permanently Less equity for heirs Table of Contents click to navigate Trusted HUD Approved Lender All Reverse Mortgage Inc.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Advantages and Disadvantages of Reverse Mortgages Reverse Mortgages can be a great tool for protecting a seniors livelihood and helping them stay in their homes as they age. Because the loan does not have to be repaid until the borrower is out of the house this distinction is mostly irrelevant.

Unlike a home equity loan with a Reverse Mortgage your home can not be taken from you for reasons of non-payment there are no payments on the loan until you permanently leave the home. Compare Our List Of Popular Reverse Mortgage Lending Companies Quickly and Easily. Web The downside to a reverse mortgage loan is that you are using your homes equity while you are alive.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Limits your financing options. For Homeowners Age 61.

Web One of the upsides of a reverse mortgage is that lenders characteristically dont impose income or credit requirements. Even better the money is usually tax-free even though its used as income. In order to qualify for a reverse mortgage you have to be able to afford your property taxes homeowners.

Failure to meet the obligations of the loan may also cause the loan to become due and payable which may be seen as a con of reverse mortgages. This value will be less than they would expect because of the higher interest rate and compounded interest. After all its a mortgage so it affects your credit score and might make it more difficult getting another type of financing.

Web Although Social Security and Medicare eligibility are not affected by a reverse mortgage loan asset-tested government programs such as Medicaid could be affected. Web Downsides of Reverse Mortgage A potential drawback is that the reverse mortgage loan becomes due when the borrower sells the home moves out of the home as their primary residence or passes away. Ad Understand the Downsides of a Reverse Mortgage Loan So You Can Make Informed Decisions.

Also Reverse Mortgages can help senior homeowners pay their day to day living expenses cover the cost of large expenses or even help them purchase a new home. Still youll be on the hook for homeowners insurance property taxes and HOA dues. With a reverse mortgage the borrower gives up home equity in exchange for payments from the lender.

Web If you might have to move due to health or disability a reverse mortgage is probably unwise because in the short run its upfront costs are unlikely to pay off. Learn About Reverse Mortgages With a Free Info Kit From AAG Americas 1 Reverse Lender. Web The downside to a reverse mortgage of course is that while the balance on a normal loan declines each month the balance on a reverse mortgage increases each month.

However you must continue to pay for upkeep and taxes and insurance on your home. There must be sufficient household income after expenses to pay property taxes and insurance.

What Is A Reverse Mortgage Understanding The Pros And Cons Of Hecm Youtube

Major Mortgage Lenders Td Cibc Let Borrowers Shift Unpaid Interest Onto Principal To Cope With Rising Costs R Canadahousing

5 Downsides Of A Reverse Mortgage

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1911 Session I Education Primary Education In Continuation Of

Warning Reverse Mortgage Downsides Disadvantages

35 Pros And Cons Of Online Shopping

Guide Reverse Mortgage Disadvantages Pitfalls Cost And Problems Advisoryhq

Reverse Mortgage Pros And Cons Bankrate

Reverse Mortgage Pros And Cons For Homeowners

Going Forward With Reverse Mortgages

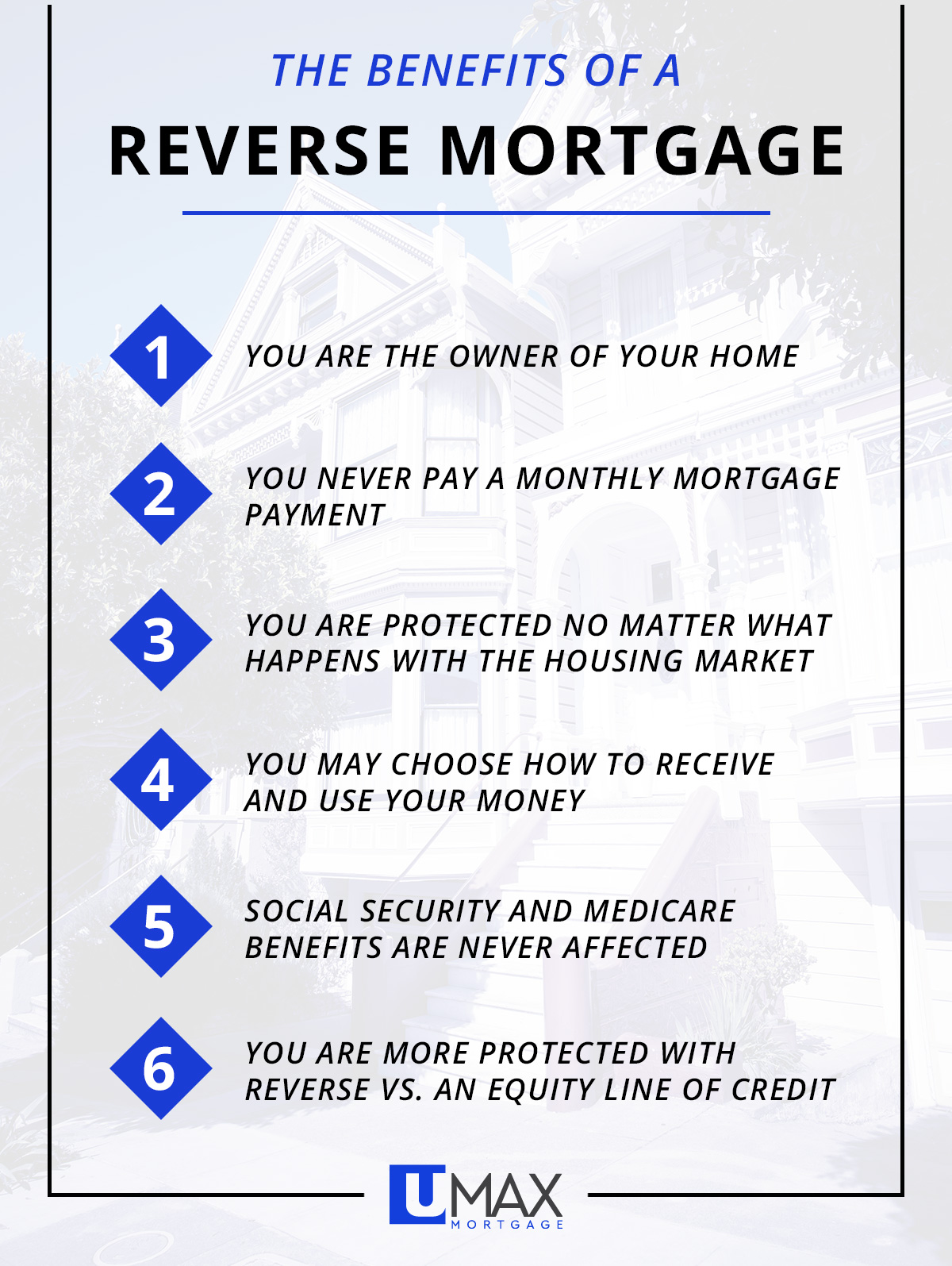

Reverse Mortgage Solutions Learn The Benefits Of Reverse Mortgages In California Umax Mortgage

Reverse Mortgage Pros Cons Starting With The Negatives

What Is A Reverse Mortgage Pros And Cons Explained

Reverse Mortgage Pros Cons Starting With The Negatives

Reverse Mortgage Everything You Need To Know

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1911 Session I Education Primary Education In Continuation Of

Major Mortgage Lenders Td Cibc Let Borrowers Shift Unpaid Interest Onto Principal To Cope With Rising Costs R Canadahousing